Investing in Stability and Growth

Sponsored Ads

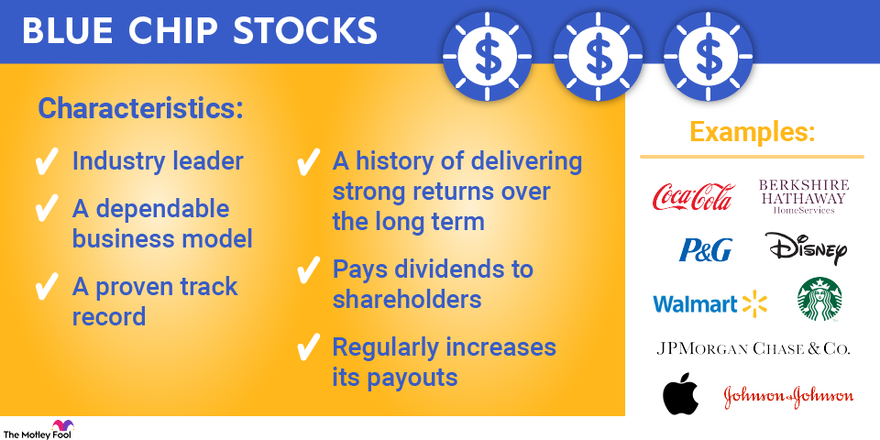

In the realm of investing, blue chip stocks stand out as a beacon of stability and growth. These stocks represent some of the most well-established and financially sound companies in the market, offering investors the opportunity to tap into the long-term success of these industry titans. This comprehensive article delves into the world of blue chip stocks, exploring their strengths, weaknesses, and how they can be a valuable addition to any investment portfolio.

Introduction: Navigating the Investment Landscape

Choosing the right stocks can be a daunting task for investors, with a multitude of options available. Blue chip stocks, however, offer a simplified approach to investing. They represent companies that have weathered economic storms, consistently delivering solid financial performance and generating wealth for their investors. These companies are often household names, recognized for their stability, reliability, and commitment to innovation.

The allure of blue chip stocks lies in their ability to provide steady returns over the long term. While they may not offer the exponential growth potential of some emerging stocks, their resilience and ability to weather market fluctuations make them an ideal choice for risk-averse investors. By investing in blue chip companies, investors gain exposure to a diversified portfolio with historically consistent performance.

The Allure of Blue Chip Stocks: Strength in Stability

Blue chip stocks are renowned for their stability, a trait that has made them a cornerstone of long-term investment strategies. These companies have weathered economic downturns, industry disruptions, and market volatility, proving their ability to withstand external shocks. Their consistent financial performance and strong balance sheets provide investors with a sense of security, knowing that they are investing in companies with a proven track record of success.

The strength of blue chip stocks lies in their ability to generate consistent earnings, even during challenging economic conditions. This stability stems from their dominant market positions, strong brand recognition, and loyal customer base. These companies have established themselves as leaders in their respective industries, offering products or services that are essential to consumers or businesses.

Investing in Stability: A Look at the Strengths of Blue Chip Stocks

1. **Financial Stability:** Blue chip companies boast strong balance sheets, with minimal debt and ample cash reserves. This financial stability enables them to weather economic downturns and invest in growth opportunities.

2. **Consistent Earnings:** Blue chip companies have a history of delivering consistent earnings, even during economic downturns. This stability provides investors with a steady stream of income.

3. **Dividend Payments:** Many blue chip companies pay regular dividends, providing investors with a source of passive income. Dividends are often increased over time, providing investors with a growing stream of income.

4. **Brand Recognition:** Blue chip companies are often household names, with strong brand recognition. This brand recognition gives them a competitive advantage and helps them to maintain their market share.

5. **Market Leadership:** Blue chip companies are often leaders in their respective industries, with a strong market share. This market leadership gives them pricing power and the ability to generate strong profits.

6. **Long-Term Growth:** While blue chip companies may not offer the explosive growth potential of smaller companies, they have a history of delivering steady, long-term growth. This growth is driven by their strong market positions, innovation, and acquisitions.

7. **Defensive Characteristics:** Blue chip companies often have defensive characteristics, making them less vulnerable to economic downturns. This defensiveness can be attributed to their strong brand recognition, customer loyalty, and diversified revenue streams.

Weighing the Risks: Potential Weaknesses of Blue Chip Stocks

1. **Lower Growth Potential:** Blue chip companies often have lower growth potential than smaller companies. This is because they are already established and have a large market share.

2. **Limited Upside:** The upside potential of blue chip stocks is often limited, as they are already trading at a premium due to their stability.

3. **Valuation Concerns:** Blue chip companies often trade at higher valuations than smaller companies. This can make it difficult for investors to find value in these stocks.

4. **Slow Innovation:** Blue chip companies can sometimes be slow to innovate, as they are focused on maintaining their market share.

5. **Regulatory Risks:** Blue chip companies are often subject to increased regulatory scrutiny due to their size and market power.

6. **Economic Downturns:** While blue chip companies are more resilient to economic downturns than smaller companies, they are not immune to these downturns.

7. **Interest Rate Sensitivity:** Blue chip stocks can be sensitive to interest rate changes, as higher interest rates can make their dividends less attractive.

Blue Chip Stocks: A Balanced Appraisal

| Strengths | Weaknesses |

|---|---|

|

|

FAQs on Blue Chip Stocks

1. **What are blue chip stocks?**

Blue chip stocks are stocks of large, well-established companies with a history of strong financial performance.

2. **What are the benefits of investing in blue chip stocks?**

The benefits of investing in blue chip stocks include stability, consistent earnings, dividends, and long-term growth.

3. **What are the risks of investing in blue chip stocks?**

The risks of investing in blue chip stocks include lower growth potential, limited upside, valuation concerns, and economic downturns.

4. **How do I identify blue chip stocks?**

You can identify blue chip stocks by looking for companies with a long history of profitability, a strong balance sheet, and a dominant market share.

5. **What are some examples of blue chip stocks?**

Some examples of blue chip stocks include Apple, Microsoft, Coca-Cola, and Johnson & Johnson.

6. **Are blue chip stocks a good investment for beginners?**

Yes, blue chip stocks can be a good investment for beginners because they offer stability and long-term growth potential.

7. **How much should I invest in blue chip stocks?**

The amount you invest in blue chip stocks depends on your investment goals and risk tolerance.

8. **When is the best time to buy blue chip stocks?**

The best time to buy blue chip stocks is when they are trading at a fair valuation.

9. **How long should I hold blue chip stocks?**

You should hold blue chip stocks for the long term, as they offer the best potential for growth.

10. **What is the average return on blue chip stocks?**

The average return on blue chip stocks is around 8-10% per year.

11. **What are the tax implications of investing in blue chip stocks?**

The tax implications of investing in blue chip stocks depend on your individual tax situation.

12. **What are the risks of investing in blue chip stocks?**

The risks of investing in blue chip stocks include lower growth potential, limited upside, valuation concerns, and economic downturns.

13. **What are the best blue chip stocks to buy now?**

The best blue chip stocks to buy now depend on your individual investment goals and risk tolerance.

Embrace Stability and Growth: The Conclusion

Investing in blue chip stocks offers investors a unique opportunity to gain exposure to the stability and growth of some of the world’s most successful companies. These stocks have consistently delivered strong returns over the long term, making them an attractive choice for investors seeking a steady stream of income and capital appreciation. While they may not offer the high-growth potential of some emerging stocks, blue chip stocks provide a level of stability and resilience that is invaluable in today’s volatile market environment.

Take Action: Harnessing the Power of Blue Chip Stocks

1. **Identify your investment goals:** Determine your risk tolerance and time horizon before investing in blue chip stocks.

2. **Research and compare:** Carefully research different blue chip companies to understand their financial performance, market position, and growth potential.

3. **Diversify your portfolio:** Invest in a range of blue chip stocks to minimize risk and maximize returns.

4. **Invest for the long term:** Blue chip