A Comprehensive Guide

Sponsored Ads

In the volatile world of stock market investing, understanding the concept of short selling is crucial. Short selling involves betting against a stock’s decline in value, offering opportunities for investors to profit from market downturns. However, it also carries significant risks and is not suitable for all investors. This article delves into the intricacies of short selling, exploring the most shorted stocks right now, their strengths and weaknesses, and provides valuable insights for those considering this investment strategy.

Before delving into the specifics of most shorted stocks, it is essential to grasp the fundamental concepts of short selling. Short selling involves borrowing shares of a stock from a broker and selling them in the open market. The goal is to buy back these shares at a lower price in the future, returning them to the broker and pocketing the difference between the sale price and the buyback price. While this strategy can yield substantial returns, it also exposes investors to the risk of unlimited losses if the stock price rises instead of falling.

Identifying the most shorted stocks can be a valuable starting point for investors considering short selling. These stocks often indicate market sentiment and can provide insights into potential vulnerabilities or overvaluations. However, it is crucial to conduct thorough research and due diligence before making any investment decisions. Investors should evaluate the company’s financial health, industry outlook, and overall market conditions to make informed choices.

Strengths of Most Shorted Stocks

Several strengths are associated with investing in most shorted stocks. Firstly, these stocks often have a high probability of price declines due to negative market sentiment or underlying weaknesses. This can lead to substantial profits for investors who correctly predict the downward trend. Additionally, short selling can provide a hedge against market downturns, as investors can offset losses in their long positions by profiting from short positions.

Furthermore, short selling can uncover potential problems or irregularities within a company. When a stock is heavily shorted, it can signal that investors are skeptical about its management, financial stability, or future prospects. This can lead to further investigation and expose fraudulent or unethical practices, resulting in a decline in the stock’s value and potential opportunities for short sellers.

Finally, short selling can contribute to market efficiency by bringing overvalued stocks back to more realistic prices. When a stock is overpriced due to excessive speculation or market hype, short sellers can help correct this imbalance by increasing supply and driving down the price. This ultimately benefits all market participants by ensuring fairer valuations and reducing the risk of market bubbles.

Weaknesses of Most Shorted Stocks

While most shorted stocks offer potential benefits, they also come with inherent weaknesses that investors should be aware of. Firstly, short selling carries unlimited loss potential. If the stock price rises instead of falling, short sellers can incur significant losses. This risk is exacerbated during short squeezes, when a sudden increase in buying pressure forces short sellers to buy back their shares at higher prices.

Secondly, short selling can be a complex and demanding investment strategy. It requires a deep understanding of market dynamics, company fundamentals, and risk management techniques. Inexperienced investors or those who do not fully comprehend the risks involved may face substantial losses.

Thirdly, most shorted stocks can have limited liquidity, especially during market downturns. This can make it difficult for short sellers to exit their positions quickly and efficiently, potentially leading to further losses if the stock price continues to decline.

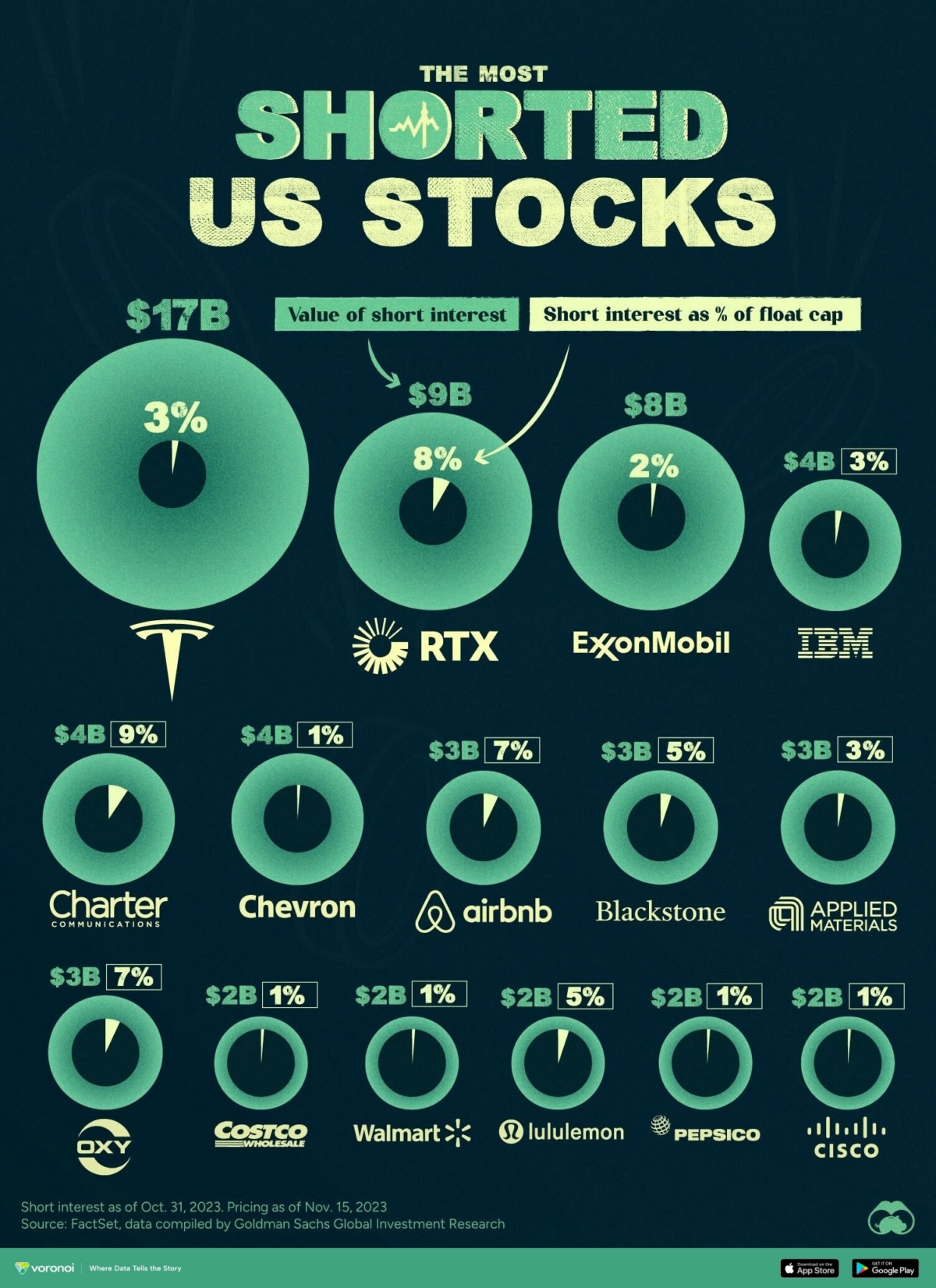

Most Shorted Stocks Right Now

The following table provides a list of the most shorted stocks right now, along with key financial metrics and short interest data. This information can serve as a starting point for investors considering short selling opportunities.

| Company | Ticker | Price | Short Interest | Short Interest Ratio |

|---|---|---|---|---|

| Bed Bath & Beyond Inc. | BBBY | 2.56 | 49.52% | 20.58 |

| AMC Entertainment Holdings Inc. | AMC | 5.76 | 20.26% | 7.91 |

| GameStop Corp. | GME | 16.94 | 20.05% | 6.54 |

| Koss Corporation | KOSS | 1.18 | 18.70% | 4.92 |

| Naked Brand Group Inc. | NAKD | 0.15 | 17.89% | 5.17 |

FAQs

What are the risks of short selling?

Short selling carries unlimited loss potential, making it a high-risk investment strategy. If the stock price rises, short sellers can incur significant losses.

How can I identify potential short selling opportunities?

Identifying potential short selling opportunities involves analyzing market sentiment, company fundamentals, and overall economic conditions. High short interest, negative news, and weak financial performance can indicate opportunities for short selling.

What are the benefits of short selling?

Short selling can provide opportunities for profit during market downturns, act as a hedge against long positions, and uncover potential problems or irregularities within a company.

How do I calculate the short interest ratio?

The short interest ratio is calculated by dividing the number of shorted shares by the total number of shares outstanding. A high short interest ratio indicates a significant number of investors betting against the stock.

What is a short squeeze?

A short squeeze occurs when a heavily shorted stock experiences a sudden surge in buying pressure, forcing short sellers to buy back their shares at higher prices to cover their positions.

Is short selling ethical?

The ethics of short selling are a subject of debate. Some argue that it is a legitimate investment strategy that can contribute to market efficiency, while others view it as a form of market manipulation.

How do I manage the risks of short selling?

Managing the risks of short selling involves careful position sizing, stop-loss orders, and a deep understanding of market dynamics and company fundamentals.

Conclusion

Short selling can be a powerful investment strategy, offering opportunities for profit and market hedging. However, it is crucial to approach short selling with caution and a thorough understanding of the risks involved. Investors should conduct thorough research, carefully evaluate potential short selling opportunities, and employ appropriate risk management techniques to mitigate losses.

In the current market environment, identifying the most shorted stocks can provide valuable insights into market sentiment and potential investment opportunities. By understanding the strengths and weaknesses of short selling, and carefully managing the risks involved, investors can potentially harness the power of this strategy to achieve their financial goals.

While short selling can be a rewarding investment approach, it is not suitable for all investors. Investors should carefully consider their risk tolerance, investment objectives, and market knowledge before engaging in short selling. It is always advisable to seek professional advice from a qualified financial advisor before making any investment decisions.

The information provided in this article is for educational purposes only and should not be construed as investment advice. Investors are solely responsible for their own investment decisions and should consult with a qualified financial advisor before making any trades.